We divide our analysis into 2 parts – Business and Management.

Business

The Company makes regulators and accessories for all types of LPG equipment. 85% of their revenue is export sales, rest 15% is from sale of Scrap materials in the domestic market.

When we research a business, we’re looking for signs that might indicate that it’s a high-quality business with some competitive advantages present. The following aspects of DHP give us those clues:

1.) Stable operating margins – The operating margins have been stable at 23-24% over the last 10 years, with only 2 years where it dipped to 18%. This has come in a period where the underlying raw materials (brass and zinc) have been highly volatile.

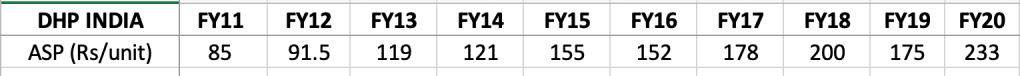

2.) Adequate pricing power – We get evidence of pricing power from 2 points – first being the operating margins, which as mentioned earlier have been stable even with volatile raw material prices. The company has easily been able to pass on cost increases. Secondly, we calculate the average selling price (ASP) from the production data given in the Annual Report. Here, we see a consistent rise in selling prices.

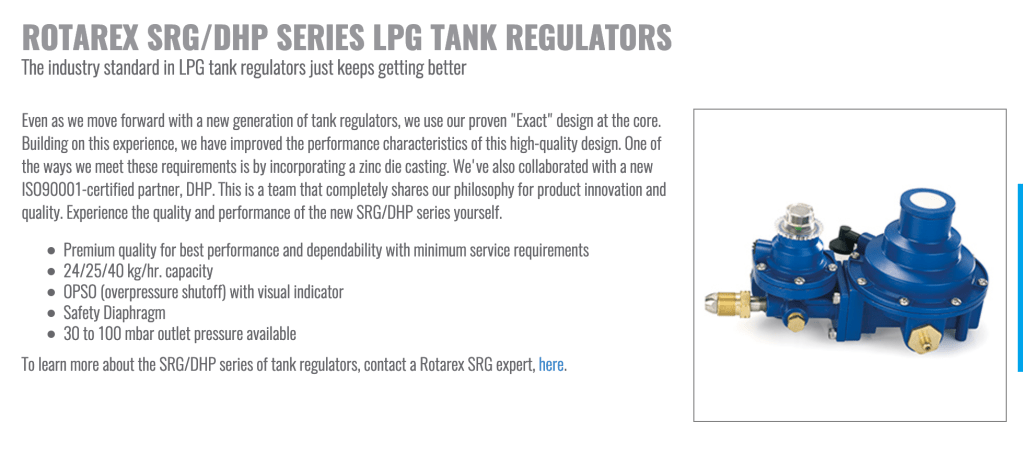

3.) High value-addition product – Since this is a micro-cap stock, we don’t get too much info about the company’s products other than the Annual Report itself. However, we were able to track down the website of one of their customers, and we see a mention of DHP India as their partner. This gives us a strong reason to believe that the product that they are supplying is a high value-addition product and not a commodity product.

This is a screenshot of the Products page of one of its clients – Rotarex SRG of Germany.

4.) Cash flows – 10yr Cumulative CFO is higher than the 10yr cumulative PAT. It indicates the company is converting profits into cash flows. Additionally, they’ve been able to grow with very little capex (10yr Capex/Dep = 1.15), which means they’re generating healthy free cash flows. This free cash has allowed them to amass a mutual fund portfolio of roughly 50cr. Not too bad for a company selling for 115cr!

5.) Capital structure – The company has a pristine balance sheet. I’ve studied the past 12 annual reports, and never have they had to raise money via debt or equity over that time. All their growth has been funded by internal accruals, and as we’ve seen above, they have loads of free cash.

6.) Negatives – It doesn’t have the twin engines of growth firing for it, i.e. it’s generating excellent returns from the capital employed, but it doesn’t have many opportunities to reinvest the earnings. As mentioned above, 10yr Capex/Dep = 1.15, which means they’re just about replacing the assets they own, not adding anything for new growth.

This has resulted in the slowing of growth recently. This is precisely the kind of business I would love to be a full owner of, where I could reinvest the cash being thrown off into other businesses.

Management

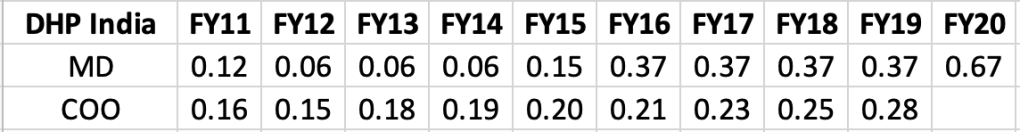

1.) Management remuneration – It has been quite reasonable throughout, staying below 4% of PAT. However, in FY20 it has grown to over 5% of PAT.

2.) Management actions – We get clues into the thinking of the management and their attitude towards the business by their actions in the years FY12-14. The company needed funds because of Capex requirements. Working capital needs were also increasing and cash flows had been lower than net profit for the previous 3 years. All this led to a cash crunch. The management coped with this by stopping the dividend for FY11 and 12. They also liquidated their (small) investment portfolio in FY11. The MD halved his salary from 12 lacs to 6 lacs per annum, whereas no salary cut was given to the COO (in-charge of production). This shows us that the promoter looks at the business as an asset, and not as a cash cow for himself and his family. He is willing to sacrifice his remuneration if an opportunity arises which requires some investment. It also shows that he values his employees highly. As a minority shareholder, these traits are important to see in a family-owned enterprise, especially in obscure micro caps.

3.) Transactions with promoter group company – The promoter group company has shown willingness to support the company, by extending loans at reasonable rates whenever there’s been a need. They’ve also leased their office to DHP at a minimal rate of Rs 1.5 lacs per year. This further strengthens the point mentioned above.

Conclusion

This is a high-quality business, with an honest management that has shown a good sense for capital allocation, as they’ve moved into a lucrative business of exporting gas pressure regulators. This has helped them build a sizeable investment portfolio, which is almost half the market cap of the company. It also speaks to the integrity of the management that these funds, which have been built over a period of 6 years, haven’t been siphoned off through investments in promoters private entities, or through other such means. However, what holds me back from investing is that the firm doesn’t seem to have many reinvestment opportunities. This tells me that the growth of the business will continue to slow down over time.